“How do you wake up Lady Gaga? Poker Face.”

“How do you wake up Lady Gaga? Poker Face.”

With that groan-inducing dad joke, the 35th Annual NTSA Summit, hosted by the National Tax-Deferred Savings Association, kicked off on Sunday in San Diego, Calif.

The opening general session, Legislative Landscapes: Federal & State Legislative Update, featured Will Hansen, Chief Government Affairs Officer at the American Retirement Association, and Nathan Glassey, NTSA Executive Director.

Glassey began by noting the 3,461 bills the NTSA reviewed last year, including 393 active bills and the 168 it has prioritized.

The duo then addressed a litany of legislative issues affecting the industry, beginning with the effort to include collective investment trusts (CIT) as options in 403(b)-plan menus, which was left out of SECURE 2.0 due to time constraints and debate over their tax regulation by banks.

The Retirement Fairness for Charities and Educational Institutions Act of 2023 (H.R. 3063) would allow 403(b) plans to offer CITs and separate account insurance contracts as investment options. Sponsored by Reps. Frank Lucas (R-Okla.) and Josh Gottheimer (D-N.J.), it’s currently looking for sponsors for a companion bill in the Senate, with Sens. J.D. Vance (R-Ohio) and Raphael Warnock (D-Ga.) as possible leads.

Hansen moved on to the start-up credit for non-profits, which is legislation to grant charitable organizations the same incentives to adopt a retirement plan and automatic enrollment features as those extended to for-profit entities under SECURE 2.0.

“Non-profits are far less likely to offer retirement plans due to the costs and administrative burden,” Hansen noted. “This proposal would deliver a tax credit against payroll tax liability for non-profits and charities, ensuring they have the same incentives as their for-profit counterparts. We’re working with both the House and the Senate to introduce legislation.”

Hansen then mentioned House Ways and Means Committee Ranking Member Richard Neal’s (D-Mass.) bill to establish a federal auto-IRA for employers with over 10 employees who do not currently sponsor a retirement plan.

The Automatic IRA Act of 2024 would require employees to be automatically enrolled in either an IRA or some other “automatic contribution plan or arrangement,” like a 401(k) plan. It would apply to plan years beginning after 2026.

The Automatic IRA Act of 2024 would require employees to be automatically enrolled in either an IRA or some other “automatic contribution plan or arrangement,” like a 401(k) plan. It would apply to plan years beginning after 2026.

The bill’s summary said it would “build upon, expand, and improve the private pension system in a manner that explicitly protects and complements employer-sponsored plans and arrangements.”

It would also “essentially be costless” to smaller employers since it would create a new tax credit of $500 per year for three years for employers of up to 100 employees that offer either a state or national automatic IRA, in addition to other existing tax credits.

The Roth IRA rollover bill was discussed next, which would allow retirement savers to roll over their Roth IRA into a Roth-designated bucket of an employer-sponsored plan—Roth 401(k), 403(b) or 457(b).

“If passed, it would greatly enhance Roth IRA portability and reduce leakage as the number of Roth accounts continues to grow,” Hansen explained.

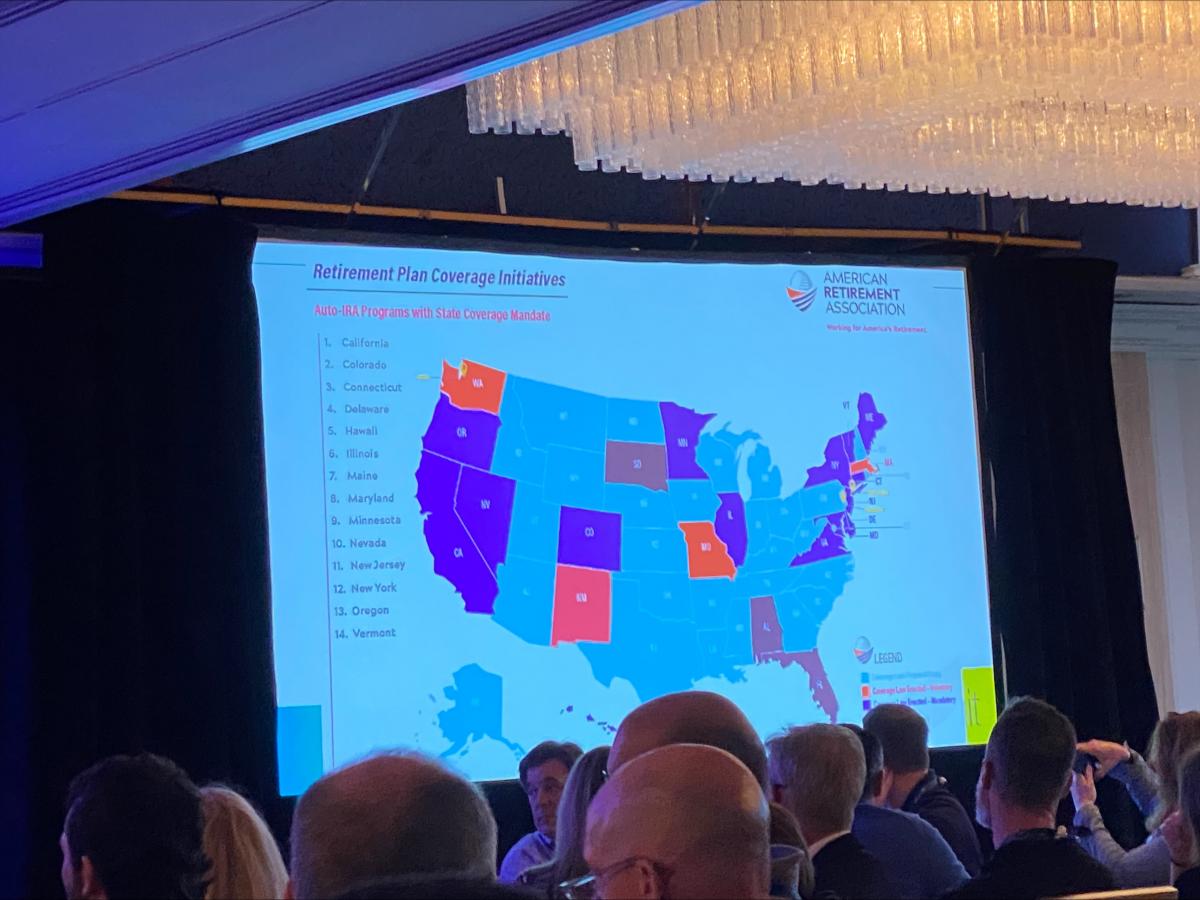

Glassey then turned to state retirement plan laws, noting that since 2012, 47 states have acted to “implement, study, or introduce legislation to establish state-facilitated retirement savings programs.” Additionally, 15 states and two cities enacted mandatory auto-IRA program laws for private sector workers.

Models utilized so far include mandatory auto-IRAs, which is the predominant model, voluntary auto-IRAs (New Mexico), a voluntary open MEP (Massachusetts and Mississippi), and a voluntary marketplace (Washington State).

- Log in to post comments