Editor’s Note: This is part one of a 3-part series. Also see the four accompanying charts at the end for complementary information.

Tax-exempt organizations have the choice of setting up either a 403(b) or a 401(k) plan. Adding to that list are the governmental public education employers (public schools) and church plans. Ensuing questions posed by the employer will revolve around “which is better?” The real answer is—it depends!

It has become a pet peeve of mine to hear stories of employers who were convinced to leave their 403(b) and set up a 401(k) plan instead. Or when presented the option an Advisor pushes them into a 401(k). While there are a few instances where the 401(k) may be more beneficial, it is our opinion there are only a few, and it could be detrimental to establish a 401(k) in lieu of a 403(b).

Some of the erroneous reasons given in favor the 401(k) plan over the years have been:

- Better investments

- Easier to administer

- 403(b) plans cannot accept employer contributions (not true)

- Easier and cheaper administration (not true)

Unfortunately, I could share some horror stories with you about marketing 401(k)s to employers that were much better suited for a 403(b) plan, but those are stories for another day.

Recently there have been many articles written against the selection of a 403(b). Below is a different take on the story showing where a 401(k) might work, but in most cases it is a travesty to not put in place a 403(b).

Case in point: When Congress added Section 414(z) to the Internal Revenue Code to permit transfers/mergers between a DC plan, including a 401(k) and a 403(b) for churches—it was done to this very point—permitting churches to merge their 401(k) into a 403(b) for those employers that were sold a 401(k) instead. We believe this option should also be available for other 403(b) employers and has been proposed in the past. We hope to see this in the future.

The Boxing Match

Since this is more of a professional bout than an amateur boxing match, we are going to go 12 rounds (unless there is a TKO) and declare the overall winner. Put on your boxing gloves and let’s get started.

Round 1—Nondiscrimination testing for Elective Deferrals

401(k) Plans. The ADP test is used to determine whether highly compensated employees (HCEs) defer proportionally more than the non-highly compensated employees (NHCEs). When this test fails, the employer must either distribute the excesses to the HCEs or contribute more to the NHCEs to satisfy the ADP test.

403(b) Plans. The ADP test does not apply. This is replaced by the universal availability rule, much easier to satisfy than the ADP test. An employer either permits all employees to defer into the plan or has the option to exclude certain employees. The Employer sends out a universal availability notice annually. No testing after that.

WINNER—403(b)

Round 2—Late Deferrals in an ERISA 403(b)/401(k)

401(k) Plans. Generally, under a 401(k) plan, if deferrals are made later than as soon as they can be reasonably segregated from the employer’s general assets but no later than the 15th day after the month that they are taken from payroll, penalties and filings apply. The employer must file a form 5330 paying the excise tax on the amount of the late deferrals.

403(b) Plans. The Form 5330 does not apply to 403(b) plans, so the excise tax does not apply either. Of course, the employer still must make the employee whole by putting the lost earnings into the plan, as is the case in a 401(k) plan.

WINNER—403(b)

Round 3—Top-Heavy Testing

401(k) Plans. Generally, under a non-safe harbor 401(k) plan the employer must satisfy Top-heavy testing.

403(b) Plans. The Top-heavy rule does not apply to a 403(b) Plan.

WINNER—403(b)

Round 4—Eligibility for Elective Deferrals

401(k) Plans. The maximum eligibility for permitting elective deferrals by employees can be structured to require one year of service. In this case if the employer has a high turnover in employees, the employer may have fewer employees that are eligible under their plan. This would reduce the amount of participants and could also prevent the employer from having more than 100 participants for purposes of a Form 5500 required audit.

403(b) Plans. There is no service eligibility that can be used under a 403(b) for elective deferrals. The Universal Availability rule applies in lieu of service eligibility.

So if the 20-hour rule doesn’t really work for the employer, this may result in an increase of employees offered the deferral option.

WINNER—401(k)

Round 5—Post-Employment Employer Contributions

401(k) Plans. The only option under a 401(k) plan would be in the year of separation, and only with respect to the compensation received through the later of 2½ months after separation from service or the end of the limitation year.

403(b) Plans. Very common in 403(b) plans is the post-employment employer contribution rule. It is typically used for the CEO or director and other key employees of a non-profit employer. This permits an employer to contribute on behalf of an employee for the year that they separate from service plus the next five years. The contribution is based on the most recent compensation earned in the last 12 months of employment.

This compensation amount is then used to determine what the 415 limitation would be for the next five years. For example, an employee could have an employment agreement that states that the individual will receive an employer contribution of $10,000 per year for the 5-year period after termination of employment. Another example would be, upon separation from service, accrued sick or vacation may be contributed as an employer contribution.

The advantage to contributing over a 5-year period permits the employer to continue to contribute if the total amount of the accruals exceeds the 415 limit for the year. Another difference between a 401(k) and 403(b) under the plan documents is that the 403(b) plan will typically have the choice to make employer contributions based on employment agreements. Keep in mind that the employer will need to perform the nondiscrimination test on these contributions if there is a highly compensated employee under the plan.

In small to mid-size non-profit organizations there may not be any employees that meet the criteria of a highly compensated employee. And if the post-employment contribution is based on the accrued sick leave and vacation, then typically there is a mixture of highly and non-highly compensated employees so that the nondiscrimination test is met.

WINNER (CLOSE BUT NOT A TKO!)—403(b)

Looking Ahead

In Part II, we will look at rounds 6-10.

Susan D. Diehl QPA, CPC, ERPA, TGPC, BCF ™ is President of PenServ Plan Services, Inc.

Opinions expressed are those of the author, and do not necessarily reflect the views of the NTSA or its members.

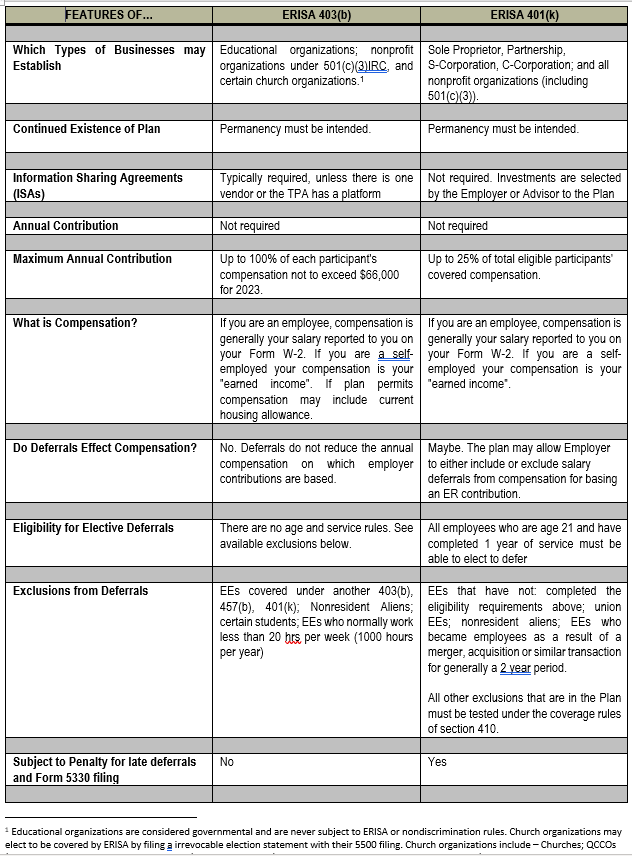

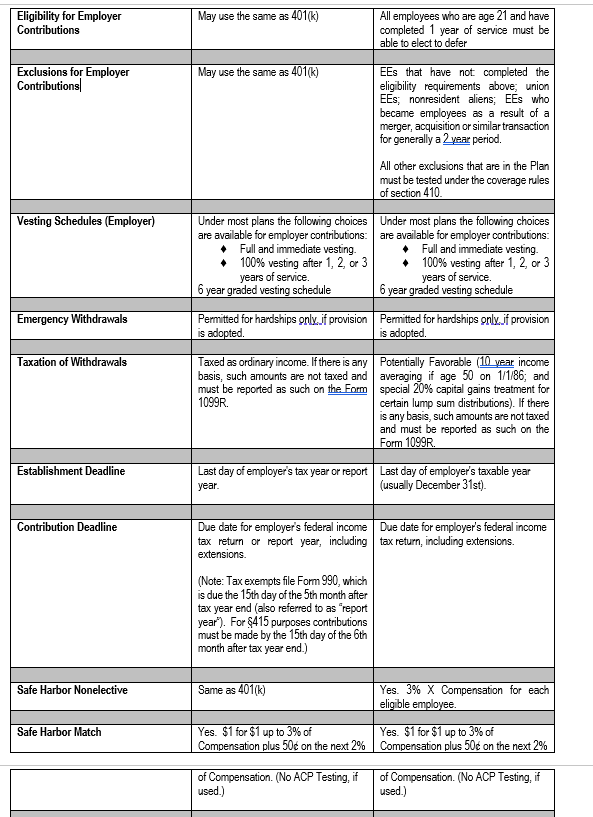

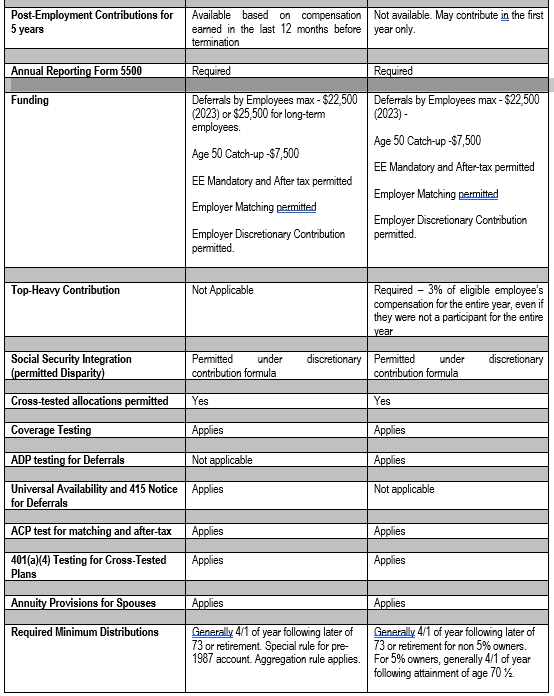

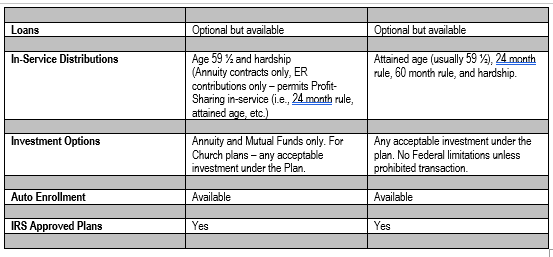

COMPLEMENTARY CHARTS

- Log in to post comments