The nuts and bolts of running a state program to provide retirement plan coverage to private-sector employees whose employers do not is occupying state governments' time lately.

Fine-Tuning the Retirement Savings Program Down East

The government of Maine has enacted a measure that adjusts its state-run retirement savings program.

Gov. Janet Mills (D) on June 12 signed into law legislation that adjusts the Maine Retirement Savings Program, the plan that provides coverage to private-sector employees whose employers do not. This comes almost exactly a year after the enactment of the Act To Promote Individual Retirement Savings through a Public-Private Partnership.

Key changes the new law makes include the following.

Phased Implementation. The Maine Retirement Savings Board may implement the program in stages, which may include a pilot program and phasing in the program based on the size of employers, or other factors.

Employer Size. A covered employer with fewer than five employees may—but is not required to—offer the program to its covered employees.

Employer Deadlines. A covered employer must offer the program to its covered employees no later than Dec. 31, 2024.

Employer Penalties. If a covered employer fails to enroll a covered employee without reasonable cause, it will be subject to a penalty for each covered employee for each calendar year or portion of a calendar year during which the covered employee was not enrolled in the program or had not opted out of participation in the program. In addition, for each calendar year beginning after the date on which a penalty has been assessed with respect to a covered employee, a covered employer will be subject to a penalty for any portion of that calendar year during which the covered employee continues to be unenrolled without opting out of participation in the program.

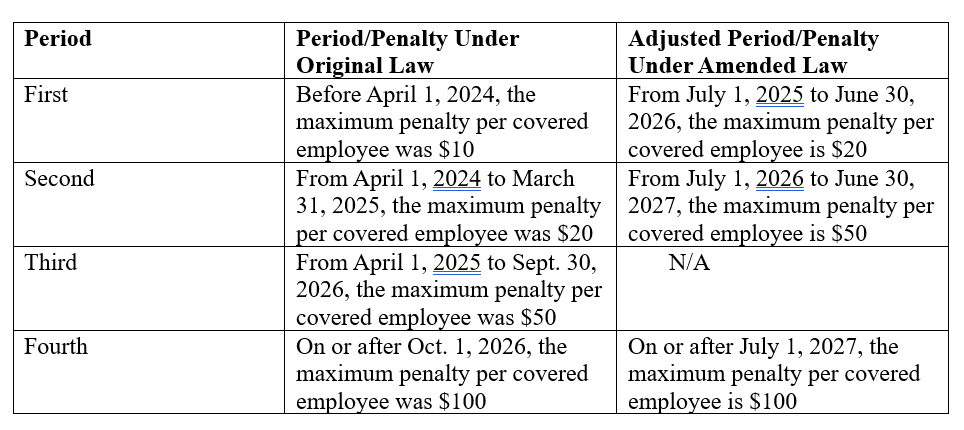

The new law also adjusts the amount of any penalty imposed on a covered employer for failure to enroll a covered employee without reasonable cause based on certain dates and periods. These were to begin on April 1, 2024 under the initial law creating the program, but now begin on July 1, 2025.

Intergovernmental Collaboration and Cooperation

The Maine Retirement Savings Board may enter into an intergovernmental agreement or memorandum of understanding with the state of Maine and any agency or instrumentality of the state in order to further the successful implementation and operation of the program through:

- the provision, receipt or other sharing of data;

- technical assistance;

- enforcement;

- compliance;

- collection; and

- other services or assistance to the program.

NJ Secure Choice Seeks Program Administrator

The New Jersey Secure Choice Savings Program Board, the entity that runs New Jersey Secure Choice—the state-run savings program that provides retirement plan coverage to private-sector employees in New Jersey whose employers do not offer one—is seeking a program administrator.

The board has issued a request for quotes (RFQ) for the position; submissions are due by 5:00 pm EDT on July 31, 2023. The administrator’s duties would include:

- recordkeeping;

- trust services;

- contributions processing;

- investment transaction processing;

- distribution processing; beneficiary tracking;

- participant service, including:

- call centers;

- web portals;

- reporting; and

- statements; and

- employer support, including:

- call centers;

- web portals; and

- reporting.

A bidder is to describe its approach and plans for accomplishing the work, set forth its understanding of the requirements of the RFQ, and its approach to successfully complete the contract. It also is to set forth its overall technical approach and its plans to meet the requirements of the RFQ in a narrative format.

A bidder is to provide the following plans and information with its submitted quote:

- implementation plan;

- roles and responsibilities matrix;

- communication strategy for employers and employees participating in the program;

- risk mitigation strategy to avoid program disruption and ensure continuity of the contract work;

- training plan for program staff;

- access control plan to ensure system access for program staff; and

- strategy.

The board says that a bidder also should submit a Disclosure of Investigations and Other Actions Involving Bidder Form with its quote, in order to provide a detailed description of any investigation or litigation—including administrative complaints or other administrative proceedings—involving any public sector clients during the past five years.

The contractor selected is to establish, maintain, and comply with a privacy policy that is consistent with all applicable state, federal and industry requirements. It also will be required to ensure its privacy policy complies with applicable federal or state laws or regulations.

About New Jersey Secure Choice

Gov. Phil Murphy (D) on March 28, 2019 signed into law the New Jersey Secure Choice Act, the measure creating the New Jersey Secure Choice Savings Program and which was to be implemented two years after the enactment date, March 28, 2021. Later, the date of implementation was delayed by one year, but the Board said that while it was aiming to implement the program by then, it “should not, and does not intend to, cut corners in providing such a new and robust program for the citizens of New Jersey.”

Currently, the program is not yet operational.

- Log in to post comments