Nevada private-sector employees whose employers do not provide retirement plans have struck gold: the Silver State has joined those that are providing such programs. The comparable plan provided by neighboring Oregon, the first state to put one in place, now counts more than $200 million in its coffers. And the next registration deadline for that plan is looming.

Silver State Strikes Gold for Savers

Nevada has become the latest state to provide a state-run plan to provide retirement plan coverage for private-sector employees whose employers do not.

The Nevada Senate passed legislation that would create the program, SB305, on May 26; the Nevada Assembly followed suit on June 4. The bill then went to Gov. Joe Lombardo (R), who signed it into law on June 13.

ARA Support. The American Retirement Association (ARA) on April 12 had sent a letter in support of the legislation to Nevada Senate Government Affairs Committee Chair Sen. Edgar Flores (D-Clark County). Said the ARA:

The ARA believes that Senate Bill No. 305 strikes the proper balance to close the retirement plan coverage gap in the private sector workforce to the greatest extent possible while imposing the minimum possible burden on Nevada’s employers. Senate Bill No. 305 requires all private sector employers with an electronic payroll system in the State of Nevada to offer a retirement plan to their employees. Senate Bill No. 305 ensures that any type of retirement plan, such as a 401(k) plan, satisfies the requirement. Further, Senate Bill No. 305 creates a state-facilitated IRA-based retirement program designed to be exempt from the Employee Retirement Income Security Act (ERISA). This approach will not force the state to compete with the many existing retirement plan products in the marketplace.

And Now. SB305 establishes the Nevada Employee Savings Trust, a state-run retirement savings program for private-sector employees. It also creates a Board of Trustees of the Nevada Employee Savings Trust and the Nevada Employee Savings Trust Administrative Fund. The money in the fund will be used only to pay the administrative costs and expenses of the board and the program.

Oregon Saves, Says OregonSaves

Participants in OregonSaves, the first state-run retirement plan for private-sector employees whose employers do not offer one, have now cumulatively saved more than $200 million through the program.

So reported the Oregon Retirement Savings Board and State Treasurer Tobias Read, who serves as board chair, on June 20. OregonSaves was launched in 2017. OregonSaves’ assets came to $113,149,423 by June 2021.

Said Read in a press release,

Six years ago, Oregon made history. We started with the belief that everyone should have an easy way to save for their retirement at work. Every Oregonian now has that opportunity. OregonSaves is delivering, and it’s more than a visionary Oregon idea; it has served as inspiration for other states—with more than $800M saved nationally for a more secure future.

Where it Stands. The board reports that now nearly 118,000 workers from more than 21,000 businesses in Oregon are saving through OregonSaves.

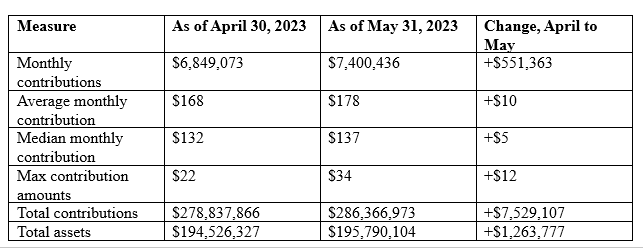

Here’s a look at contributions and assets as of May 31.

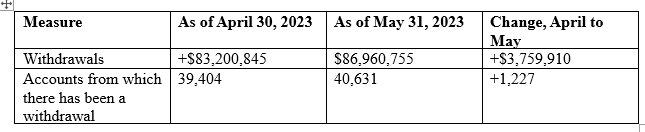

Participants can make withdrawals from their accounts, as well.

Next OregonSaves Deadline Looms

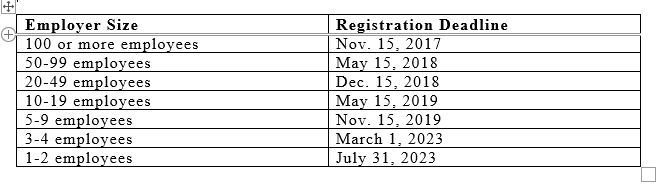

The next registration deadline that further expands the reach and coverage of OregonSaves is coming soon.

July 31, 2023 is the date by which the following must register with OregonSaves:

- employers with one or two employees, and

- businesses that use a professional employer organization (PEO) or leasing agency.

OregonSaves was launched in 2017. It has had a tiered rollout:

- Log in to post comments