The Social Security Administration (SSA) announced Oct. 12 that the monthly Social Security and Supplemental Security Income (SSI) benefits will increase 3.2% in 2024. The change will affect more than 71 million Americans and translates to an increase in Social Security benefits of more than $50 per month starting in January 2024.

The increase for 2024 is much more modest than that for 2023: 3.2% as opposed to the 8.7% announced one year ago. Consequently, the increase in the monthly Social Security benefit for 2024, more than $50 per month, is similarly more modest than that for 2023, which was $140 per month.

The 3.2% cost-of-living adjustment (COLA) will begin with benefits payable to more than 66 million Social Security beneficiaries in January 2024. Increased payments to around 7.5 million SSI beneficiaries will begin on Dec. 29, 2023.

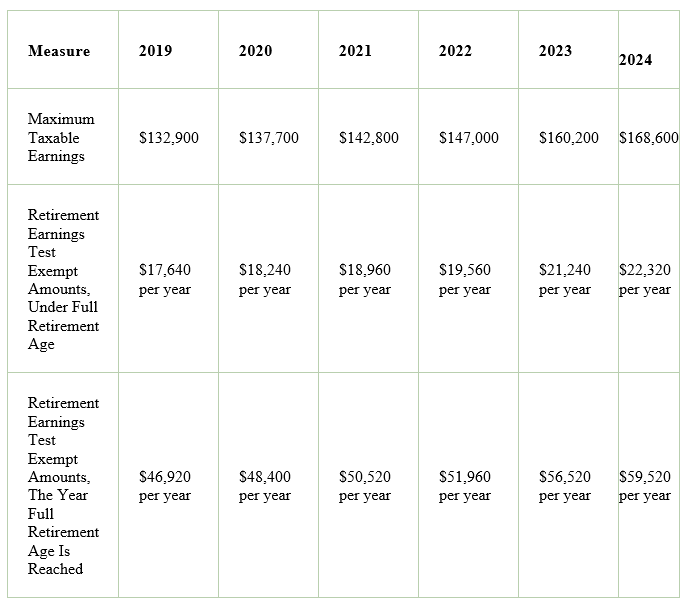

Based on the increase in average wages, the maximum amount of earnings subject to the Social Security tax (taxable maximum) will increase to $168,600 from the 2022 level of $160,200.

The earnings limit for workers who are younger than “full” retirement age will increase to $22,320. SSA notes that $1 in benefits will be withheld for each $2 earned over $22,320.

The earnings limit for people reaching full retirement age in 2024 will increase to $59,520. Here, SSA says that $1 will be deducted from benefits for each $3 earned over $59,520 until the month the worker reaches full retirement age. There is no limit on earnings for workers who are in “full” retirement age or older for the entire year.

Rates have been rising steadily:

More detailed information about the changes relevant to Social Security benefits in 2024 is available here.

- Log in to post comments