As a financial advisor to educators, are you ready for the Great Wealth Transfer?

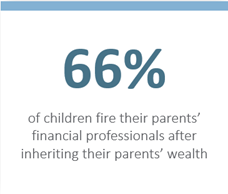

As trillions of dollars transfer from baby boomers to the next generations over the coming decades, many advisors fear seeing their managed assets slip from their grasp as clients’ beneficiaries take their money elsewhere. In fact, 66% of children fire their parents’ financial professionals after inheriting their parents’ wealth! Will this happen to you?

clients’ beneficiaries take their money elsewhere. In fact, 66% of children fire their parents’ financial professionals after inheriting their parents’ wealth! Will this happen to you?

In the upcoming two to three decades, as much as $84.4 trillion from 45 million U.S. households will be passed down from older Americans to younger generations, including $15.8 trillion from the silent generation—the one preceding the Baby Boomers—while a whopping $53 trillion will be transferred from baby boomer households. The balance is projected to go to charities.

Are these your clients today—at or near retirement? What will happen to these assets over the next 5-15 years?

Keys to Success

Key #1 – Get Connected with Your Clients’ Heirs

The first key to success is in how you can connect to your clients’ beneficiaries and convince them to retain you as their own advisor. You should have a strategic plan to establish solid relationships with your clients’ heirs before they inherit to retain the family’s business.

The good news for you is that a majority of teachers would like the help of a financial advisor to help guide them in these decisions. In fact, according to a recent study sponsored by Security Benefit, 52% of all educators would prefer to learn about managing finances from a financial professional as opposed to all other methods[1].

For upcoming generations—X and Millennials, talk about them, their future, and what’s going to happen rather than getting bogged down on talking about you and your credentials and history. Sell them on their future success and how you can help them achieve it rather than on your resume of past success.

There are many ways you can be proactive in connecting to your clients’ beneficiaries. Here are a few:

- With your client’s approval, send an email to the heirs introducing yourself and your services.

- Include a link to a resource center on your website detailing all services at their disposal, including educational materials, calculators, the ability to schedule family meetings, etc.

- Host a client appreciation dinner, barbecue, or wine and cheese event and encourage clients to invite their kids.

- Ask beneficiaries how they would like to be contacted and how frequently, then add them to your electronic contact list in the right category so they receive the level of touch that they want.

- Offer to host a regularly scheduled family meeting that includes the heirs to make sure everyone is on the same page.

Key #2 – Get a Seat at the Estate Planning Table

Estate planning allows your clients to secure their future medical care and make important arrangements such as guardianships for their children. Through the Great Wealth Transfer, however, the financial piece will take the center stage. And this is where you get to lead.

To ensure you are leveraging estate planning with your clients and their beneficiaries, there are two areas you need to assess: your practice and your clients.

In order to meet your clients’ needs at this time, you must ask some questions:

- Do you have estate planning software to enable your clients to be involved in planning for their future?

- Have you established relationships with estate planning attorneys so that you can take the lead on the financial portion?

- Is there a plan for managing relationships with trust administrators who specialize in opening, approving, and monitoring trust accounts?

- How will you collaborate with these administrators while you and your client maintain investment discretion and ongoing management of assets?

The networks and relationships you build with estate planning attorneys and trust administrators will require ongoing oversight. Having your team and technology in place streamlines the entire estate planning process and helps to keep client relationships strong.

Once your systems are in place from the assessment of your practice, you’ll be in a good place to begin talking to your clients to assess their estate planning:

- Have you met with your clients to assess their estate plans?

- Do they already have one in place and, if so, do they need to make updates?

- Have you included your clients’ heirs in these discussions?

- Do they have the financial tools in place to preserve their income that can also be passed along to heirs?

- Your clients may, of course, be younger teachers who will become the heirs to their parents' estates! How can you help your existing Gen X and Millennial clients to work with their parents on estate planning?

As you move through the assessment process, you may identify opportunities to grow your practice, expand your network, and enhance your own book of business. The key is to be proactive. Don’t wait for your clients to ask for help—they may not know what they need, or they may think they are covered. Act now and proactively assess your clients’ estate planning needs.

Footnote

[1] Directions Research conducted the study through a poll of 502 U.S. adults over the age of 25 who are teachers or administrators in K-12 education.

Don Wiley is Vice President, Director of Affiliate Relationships at Security Benefit.

- Log in to post comments