The nation’s youngest members of the workforce have ambitious goals to retire at an early age, though they also believe they are facing more obstacles to do so than those before them.

In fact, according to Charles Schwab’s annual nationwide survey of 401(k) plan participants, Gen Z workers (21–26 years old) want to retire by age 61, but nearly all (99%) say they are facing obstacles to saving for a comfortable retirement—which is a 9% increase over last year and slightly higher than the 88% of Millennials, 91% of Gen Xers and 86% of Boomers who say that.

Not surprisingly, inflation (54%), keeping up with monthly expenses (35%), and paying for unexpected expenses (31%) are among Gen Z’s top obstacles. Gen Zers are also the most likely to say financial stress has impacted their ability to do their job (26%), followed closely by Millennials (22%), while Gen Xers (15%) and Boomers (10%) report a much lower impact.

“Younger workers are still finding their financial footing in an economic environment that is challenging for everyone. They are just starting out, so it’s no surprise that they may feel greater financial pressure, especially with such an ambitious timeline to retirement,” said Brian Bender, head of Schwab Workplace Financial Services.

Bender adds, however, that saving for retirement and paying the bills doesn’t need to be an “either/or” situation. “You can work toward multiple financial goals at once. This is especially important for younger workers to remember as student loan payments resume and become yet another monthly expense for many.”

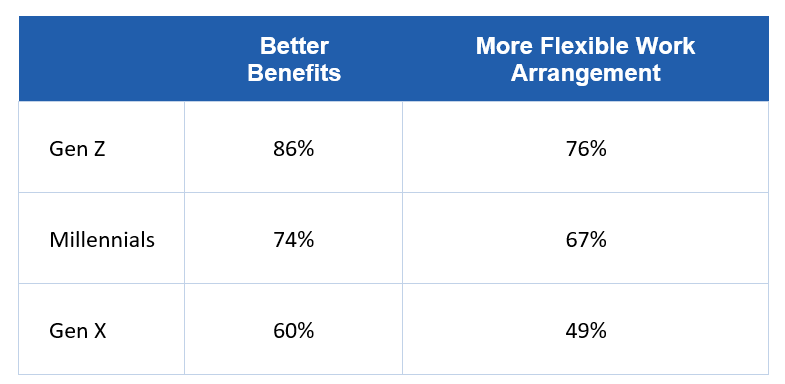

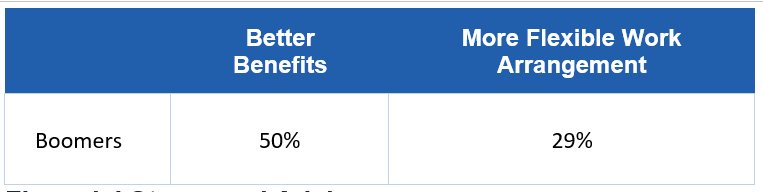

Despite the financial challenges that younger workers are facing, they apparently are more willing than older workers to forgo a salary raise for better benefits or more flexible work arrangements, such as a hybrid or remote setting or more flexible hours.

On a positive note, more than half of all workers say that their employer did something in the past year that helped them manage their financial stress.

Gen Z (71%) is the most likely to say that their employer took steps to help in the form of increased pay (31%), increased 401(k) match (25%), increased current employee benefits (23%), additional bonus (19%), decreased hours for better work-life balance (17%), and new employee benefits (15%).

Somewhat surprisingly, Gen Z workers—more than any other generation—believe that their financial situation warrants advice from a professional (Gen Z (62%) vs. Millennials (56%), Gen X (56%), and Boomers (52%)).

Specifically, they would like more personalized 401(k) advice as almost half are not sure what investments to choose for their 401(k). Gen Z is also much more likely than older workers to want more help managing their current expenses to save more for retirement (Gen Z (41%) vs. Millennials (31%), Gen X (26%), and Boomers (14%)).

Gen Z is already tapping into several sources for advice, more proactively than their older peers. In fact, nearly all (98%) say they are currently seeking financial advice from at least one source, compared to 81% of Millennials, 82% of Gen X, and 85% of Boomers.

However, they also apparently are relying more on family and friends for advice, as opposed to their 401(k)-plan provider or their employer.

- family and friends (52%)

- through my 401(k) provider (37%)

- through my employer (31%)

- my financial advisor (30%)

- social media (28%)

In contrast, Millennials, Gen Xers and Boomers all rely on their 401(k) provider or financial advisor as their top sources of advice.

The survey also found that Gen Z (75%) and Millennials (66%) are comfortable asking AI tools for help with financial planning. That said, adoption is still very low across generations (Gen Z (9%), Millennials (8%), Gen X (3%) and Boomers (2%)).

And while Gen Z and Millennials are more likely to follow recommendations from a human financial professional than a computer, they are more open to both types of advice overall than their older peers.

“It’s encouraging that younger workers are so open to different sources of human and digital advice, and that they are actively seeking it out,” said Marci Stewart, Director of Communications Consulting and Participant Education at Schwab Workplace Financial Services. “When workers engage, that’s when a professional can really help them with decision-making and financial next steps. We know having a plan in place boosts employee confidence and can lead to better outcomes.”

The findings are based on an online survey of 1,000 U.S. 401(k) plan participants conducted by Logica Research between April 19 and May 2, 2023. Survey respondents were actively employed by companies with at least 25 employees, were 401(k) plan participants and were 21-70 years old. To analyze Gen Z results against other generations, an additional 100 plan participants aged 21 to 26 completed the survey.

Detailed results can be found here.

- Log in to post comments