Editor's Note: This feature in the NTSA Advisor provides a look at what’s going on in the states and the most recent developments in their activity to provide and enhance retirement plan coverage.

Bills before the legislatures in Minnesota, Maine, and Illinois would adjust retirement savings vehicles in those states.

‘Nerdy’ American Retirement Association Praised in Minn. Retirement Plan Vote

John Sullivan

A bill to establish the Minnesota Secure Choice Retirement Program (HF 782), a state-sponsored auto-IRA, passed through the Ways and Means Committee in the Minnesota House on Monday with the bill’s author praising “nerdy group” American Retirement Association (ARA) for its help and support.

Rep. Jamie Becker-Finn, DFL-Roseville, who introduced the bill, cited research in her remarks before the vote that found more than 70% of workers earning between $30,000 and $50,000 per year participated in a retirement plan when offered through their employer. When not provided, participation in any retirement program or product fell to below 5% of workers within that salary range.

Rep. Jamie Becker-Finn, DFL-Roseville, who introduced the bill, cited research in her remarks before the vote that found more than 70% of workers earning between $30,000 and $50,000 per year participated in a retirement plan when offered through their employer. When not provided, participation in any retirement program or product fell to below 5% of workers within that salary range.

“It’s a very nerdy group to brag about getting support from, but the American Retirement Association is a big deal,” Becker-Finn, a small business owner, said. “The ARA recognizes that despite our best efforts in the private sector, there are far too many Americans without access to a retirement plan at work. So that is what we are trying to fix in this bill and would appreciate everyone’s support.”

While the bill awaits Senate Committee action, any grassroots efforts by advisors would aid in its passage, proponents said.

“In recent years, state governments have taken steps to close the retirement plan coverage gap in their jurisdictions with the enactment of laws such as HF 782,” ARA wrote in a letter to Minnesota lawmakers. “A key policy feature of most of these automatic IRA programs is a requirement that businesses over a certain size provide access to some type of retirement plan to their employees.”

It added that if employers do not already offer a workplace retirement plan, or do not want to adopt one available to them in the private marketplace, they can enroll their employees in the state program. To date, 12 states have enacted these programs.

Specific features of the Minnesota bill include:

- Participation in the program is mandatory for employers that do not sponsor their own workforce retirement savings plan, such as a 401(k) plan.

- The board of directors will set the initial contribution rate and an auto-escalation schedule.

- Employees can elect whether their contributions will be pre-tax or after-tax (Roth), can opt out of participation, or change the contribution rate.

- The annual limits on contributions to an account under the program are the federal IRA limits, which are $6,500 for individuals younger than age 50 and $7,500 for individuals aged 50 or older (these amounts are for 2023 and are annually adjusted by the U.S. Treasury Department).

- Employees direct the investment of their accounts into an array of investment funds offered through the State Board of Investment (similar to employee investment accounts in the Minnesota Deferred Compensation Plan).

- Upon leaving employment, an employee will be able to leave the employee’s account with the state for distribution at a later date or elect a distribution in the form of a lump sum or other options to be determined by the board, including lifetime income options.

“The ARA believes that HF 782 strikes the proper balance to close the retirement plan coverage gap in the private sector workforce to the greatest extent possible while imposing the minimum possible burden on Minnesota’s employers,” the ARA concluded in its letter. “This approach will not force the state to compete with the many existing retirement plan products in the marketplace.”

No ESG in Maine Public Employees Retirement System Investments?

John Iekel

A bill has been introduced in the Maine House of Representatives that would prohibit consideration of nonpecuniary factors such as environmental, social, corporate governance (ESG) factors in investment of Maine Public Employees Retirement System funds.

Rep. Chad Perkins (R-Dover-Foxcroft) introduced LD 1562, an Act to Protect the Retirement of State Employees and Teachers by Establishing Standards for Fiduciary Responsibility, on April 11, 2023.

This bill would establish certain standards of care for fiduciaries of the Maine Public Employees Retirement System and would generally prohibit decisionmaking regarding investments in the retirement system based on certain nonpecuniary factors such as ESG, ideological or political factors.

More specifically, the bill provides that a fiduciary's evaluation of an investment, or evaluation or exercise of any right appurtenant to an investment must take into account only pecuniary factors. A fiduciary:

- could not promote nonpecuniary benefits or any other nonpecuniary goals; and

- could consider nonpecuniary benefits only if the factors present economic risks or opportunities that qualified investment professionals would treat as material economic considerations under generally accepted investment theories. A fiduciary would be required to evaluate those factors to:

- prudently assess the impact of the factors on risk and return;

- examine the level of diversification, degree of liquidity and the potential return or risk in comparison with other available alternative investments that would play a similar role in the plans' portfolios; and

- determine whether greater returns can be achieved through investments that rank poorly on ESG factors.

Status. The bill was referred to the House Committee on Labor and Housing.

Amendments to Maine Retirement Savings Program Proposed

John Iekel

Bills are before the Maine legislature that would amend the Maine Retirement Savings Program in a variety of ways.

Bills are before the Maine legislature that would amend the Maine Retirement Savings Program in a variety of ways.

Background. Gov. Janet Mills (D) signed the Act To Promote Individual Retirement Savings through a Public-Private Partnership (LD 1622) into law June 24, 2022. The legislation had been introduced by Sen. Eloise Vitelli (D-Sagadahoc).

That measure requires each covered employer to allow its covered employees to decide whether or not to contribute to a payroll deduction Roth IRA by automatically enrolling them but with the opportunity to opt out. Covered employees who opt out will be automatically reenrolled at regular intervals but will have the opportunity to opt out again. It also created the Maine Retirement Savings Board to administer the program.

Changes Afoot?

Legislation before the Maine Senate and House of Representatives would amend the measure that creates the program. Sen. Vitelli also introduced this measure, SP 451. The bill would change provisions affecting employees, employers, and the Board.

Employees. The law as enacted provides that covered employees will automatically contribute 5% of their salary or wages initially, and may elect to contribute at a higher or lower rate. It also calls for an annual increase of contribution rates by no more than 1% of wages or salary up to a maximum of 8%. SP 451 calls for that maximum to be increased from 8% to 10%.

Employers. The bill would postpone the dates by which covered employers are required to participate in the program and similarly postpones the dates when the board may begin assessing penalties to covered employers who fail to participate. SP 451 also specifies that covered employers are deemed to have given reasonable notice of the need to participate in the program after the program has communicated the need to participate three times.

Maine Retirement Savings Board. SP 451 includes provisions that would allow the Board to:

- establish that it must meet no less than quarterly;

- enter into an intergovernmental agreement or memorandum of understanding with the state and any agency or instrumentality of the state in order to further the successful implementation and operation of the program; and

- change the name of the program.

The bill also provides that Board employees (1) could participate in the state health insurance plan and (2) participate in the defined contribution plans offered by the Maine Public Employees Retirement System without being required to participate in the defined benefit plan the system offers.

Status. SP 451 was introduced in the Senate on March 9 and is before the Committee on Health Coverage, Insurance and Financial Services. It was introduced one week later in the House and is now before that chamber’s Committee on Health Coverage, Insurance and Financial Service.

Illinois Bill on Providing Services to 457s Progressing Through Legislature

John Iekel

A bill that would allow a financial institution or investment provider to offer or provide services to certain 457 plans is progressing through the Illinois legislature.

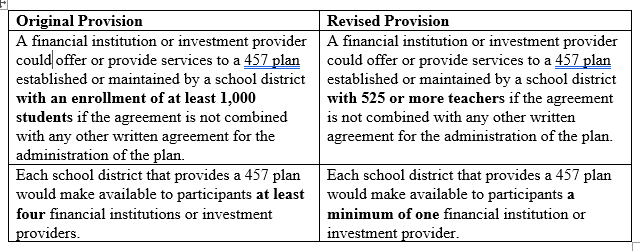

The bill originally provided that a financial institution or investment provider, by entering into a written agreement, may offer or provide services to a 457 plan established or maintained by a school district with an enrollment of at least 1,000 students if the agreement is not combined with any other written agreement for the administration of the plan.

The bill further originally stipulated that each school district that provides a 457 plan would make available to participants at least four financial institutions or investment providers that (1) have not entered into a written agreement and (2) that provide services to the school district's 457 plan. And it would set requirements for a financial institution or investment provider that serves a 457 plan.

Senate amendments. The Senate amended the bill in these ways:

The Senate also added language providing that a school district would have one year from the effective date of the Act to find a 457 plan provider.

Status. SB 1233 passed the Senate on March 23, 2023 in a 54-0 vote. On the same day it was introduced in the Illinois House of Representatives by Rep. Stephanie A. Kifowit (D-Aurora). It is now before two committees of that chamber: Rules, and Personnel & Pensions.

- Log in to post comments