Joey Santos Jones

Do you feel confident selling SECURE 2.0 to clients? Some attendees of the Day 3 session "Selling SECURE 2.0" at ASPPA Annual felt so-so about it. The Oct. 24 session featured Executive Director of PSCA Will Hansen, JJ McKinney from EGPS and Kirsten Curry from LRS as they unspun the most talked-about provisions in SECURE 2.0, how state-run plans affect sales and some of the other least "sellable" options of the legislation.

The session led by presenting some of the biggest reasons SECURE 2.0 should be sellable.

Those included:

- Changes re-engage our industry with our clients

- Prompt and prudent consulting brings order to chaos

- Referral sources, prospects, and clients

- Getting more small businesses than ever before, talking about a retirement plan.

- Getting more people than ever before talking about saving for retirement

One of the most popular ways to increase sales? That would be tax credits. While McKinney doesn't usually "doesn't go too deep" in explaining tax credits to clients, he refers them to their CPA to better evaluate their "whole tax situation with their accountant." Curry similarly finds that clients don't necessarily "want a deep dive" and love just hearing the potential for savings. Curry points out that in some cases, they can have the "majority of startup costs covered by the credits."

The discussion then turned to Hansen, who provided a wealth of data from PSCA surveys to back what he's seeing from the plan sponsor side. For plan sponsors, implementation of SECURE 2.0 provisions remains a top priority for nearly two-thirds of plan sponsors, Hansen presented.

What provisions drew the least and most excitement with plan sponsors?

Provisions with the least amount of excitement:

- Roth catch-up

- RMD changes

- Family attribution

- Emergency savings (sidecar)

Provisions with a moderate amount of excitement:

- Roth employer contributions

- 403(b) MEPs

- Emergency savings/personal savings

Additionally, Hansen highlighted that the three most talked about provisions are tax credits, cashout limit and auto-enrollment.

What other questions are plan sponsors asking (now)?

- Emergency Savings (plan sidecar) vs. Personal savings Sponsors asking – do we need this?

- If yes, do you want to offer a plan-related or external savings account?

- What would the intended outcome be if you were to add a savings offering?

One huge topic Curry hears about from clients during her prospecting process is the topic of state-run plans. Curry describes how some clients may "instinctually" not want a state-run plan. Some clients, Curry points out, enjoy having the talking point that "our company is offering an employee benefit." She also described how some prospects (during the sales process) like being able to say they offer a "retirement program" versus a state-run program.

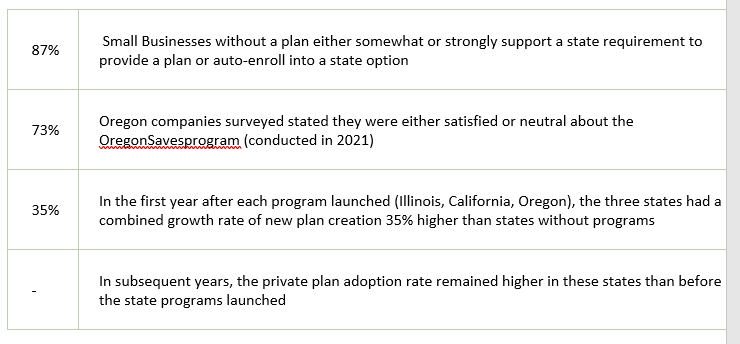

Rise in State-run Programs by the Numbers

Hansen describes that despite the state vs. private mindset—some companies could grow their understanding of "what a retirement plan is" and offer a 401(k) plan in the future with that solidified knowledge if they opt for a state-run plan first.

McKinney seconded the idea that companies will inherently want more "flexibility" in the future and want to give "employees that contribution" as their knowledge grows around 401(k) plans.

Hansen wrapped up the session by presenting what plan sponsors are looking for and appreciate most from their TPA. As a whole, plan sponsors wanted exceptional education resources provided to them, including:

- Checklist of all items, what is required versus optional, and the pros/cons of when it is the plan sponsor choice

- How are HRIS/payroll services working on programming (specifically the Roth CU issue)

- Webinars and articles

- Engaging flyers or information sheets

- The information, especially consolidated calendars of upcoming bullet points

Recent Comments

Does the roth requirement for catch-up contributions for people who earned $145,000 apply to 457...

Hi Ed,

I really liked this article and I think you make a lot of sense. And I had no...

I believe there's a misstatement in that last quote - it should refer to governmental and...

Working with several medical providers as clients, I note that the high-end earners tend to push...

Congratulations to NTSAA for landing a good one. Nathan's breadth of experience and...