John Iekel

The industrial revolution, 21st century-style, mass-produces information—but at the same time makes it an individual experience. And that includes information about retirement plans and one’s own retirement plan and account.

One of the ways in which that information is delivered is via apps. But how interested are participants in that form of access to information? And is there a difference among different generations?

Ripe for Harvest

Plan participants certainly do evince interest in information from their employers and plan providers, as well as interest in receiving it electronically.

For instance, in its study “Financial attention through multiple digital channels,” Vanguard said that during the period 2015-2017, the desktop browser was the most popular electronic means of obtaining information. They further said that more than 95% of “attentive investors” who logged in at least once over that period used one. Escalent in its examination of defined contribution plan participants similarly reported that in 2020, 81% said they logged into plan providers’ websites.

Move to Mobile

During 2015-2017, said Vanguard, while more than 90% of attentive investors who logged in at least once over the study period used a desktop browser, 40% used a mobile device, and just 20% used an app.

Still, during those years, use of mobile technology was growing. Vanguard said that among investors that have only DC plans, use of mobile access increased markedly. Vanguard said that during that period, use of mobile devices complemented desktop use, but they anticipated that it could substitute for desktop use in the future.

The future may have come a bit faster than Vanguard expected. Julie Agnew and Olivia S. Mitchell in “The Disruptive Impact of FinTech on Retirement Systems” wrote in 2019 that they considered mobile savings apps to be one of the “harbingers of innovations to come.”

The Plan Sponsor Council of America, in its PSCA’s 64th Annual Survey of 401(k) and Profit Sharing Plans report on the 2020 plan-year experience of 518 plans, said that in the period 2015-2020, the use of mobile apps increased by 80% and that by its end, 64.9% of participants used them. Escalent Senior Product Director Sonia Davis narrowed the focus in remarks about their 2020 study, saying that they found Millennials and members of Generation X to be more attuned to using mobile apps.

In a financial wellness study released early in 2022, T. Rowe Price, Duke University’s Common Cents behavioral finance lab, and financial wellness provider Retiremap said they found that financial professionals consider apps that monitor finances and track accounts to be among the most important tools in a financial wellness program.

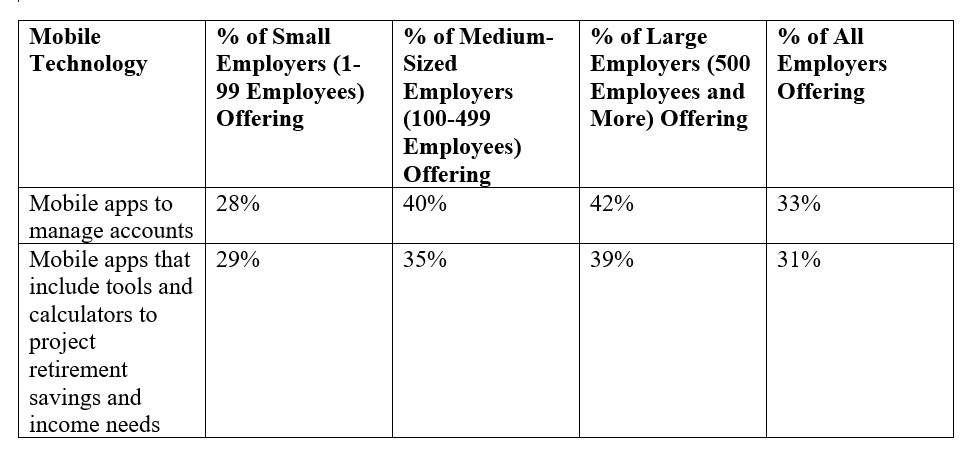

Size matters. In a survey of 1,903 employers conducted late in 2020, Transamerica found that larger employers were more likely to offer mobile apps to help employees plan and save for retirement.

To Investors’ Taste

In 2018, Vanguard expressed the expectation that just as consumers were drawn to using mobile devices for shopping, news and social connection, so too would investors be drawn to their use.

Curiosity at Work reported that CNBC found that in 2021, 60% of new investors used a mobile app to invest; that was a whopping 35 percentage points higher than the percentage of those who started investing before 2019.

JD Power in its 2022 U.S. Wealth Management Digital Experience Study said that an increasing number of investors used mobile apps as the first resource they consulted to review investments, conduct transactions, and research. This, they said, was especially true for younger investors. They reported that cohort had much higher overall satisfaction and stronger brand loyalty with frequent use of their firm’s wealth management app.

JD Power also found that investors were even more satisfied with retirement plan websites and apps when they offer proactive guidance and help.

App Effects

Key findings of the J.D. Power study include that apps:

- Are more popular than websites. J.D. Power said that users were more satisfied with U.S. wealth management mobile apps than with wealth management websites. More specifically, they reported that on a 1,000-point scale gauging satisfaction, apps had a score of 731 and websites had a score of 681.

- Attract younger job candidates. J.D. Power suggests that apps could be a helpful tool in recruiting and keeping younger employees. They found that satisfaction with wealth management apps decreases as age increases. It stood at 760/1000 for Generation Y and 720 for Generation Z. For Generation X, Baby Boomers and Pre-Boomers, satisfaction with wealth management apps was lower.

- Drive strong brand loyalty. J.D. Power said that top-performing mobile apps are stronger brand assets than top-performing websites; Net Promoter Scores on a scale of 1-100 stood at 83 for the former and 73 for the latter.

In 2022, J.D. Power further found that those who use apps engage with a brand more often and are more likely to recommend that brand when they have a positive experience.

Looking Ahead

Vanguard has said that despite the common perception that younger people are more likely to prefer access to information via mobile devices, they expect that the passage of time will mitigate that and interest in mobile access will not be isolated to just that demographic group.

And the researchers in the T. Rowe Price/ Duke University/Retiremap study expressed the view that financial wellness solutions “may work best using a range of tactics and resources” —and they include mobile apps.

Recent Comments

Does the roth requirement for catch-up contributions for people who earned $145,000 apply to 457...

Hi Ed,

I really liked this article and I think you make a lot of sense. And I had no...

I believe there's a misstatement in that last quote - it should refer to governmental and...

Working with several medical providers as clients, I note that the high-end earners tend to push...

Congratulations to NTSAA for landing a good one. Nathan's breadth of experience and...