There have been significant changes to the IRS Pre-Approved Defined Contribution Plan Program, and two of the IRS officials involved in the thick of it recently provided a refresher on the program rules and recent developments.

Milo Atlas of the Retirement Plan Forms and Publications Office at the IRS, and Angelo Noe, a Program Coordinator at IRS Return Preparer Office, in a Jan. 23 webinar offered their insights and discussed technical and procedural requirements for the upcoming 4th cycle 401(a) defined contribution pre-approved plan submission period.

Central to recent developments is Revenue Procedure (Rev. Proc.) 2023-37, which the IRS issued in November 2023. It provided fresh guidance on qualified pre-approved plans and 403(b) pre-approved plans, and combined, conformed, clarified, and updated rules for those plans set forth in prior revenue procedures.

Following are highlights of the discussion.

Self-Corrections

The self-correction period for a provider or adopting employer that fails to adopt an interim amendment is limited to a two-year period for purposes of remaining a pre-approved plan, says the revenue procedure.

“A welcome change” was how Noe categorized another provision of the guidance which states that the deadline to adopt an interim amendment for a pre-approved plan has been changed to match the remedial amendment period (RAP) deadline of an individually designed plan. “Self-correction has become a much more viable option under EPCRS,” especially under Section 305 of the SECURE 2.0 Act, said Noe.

Opinion Letters

Application procedures for opinion letters are among the matters Rev. Proc. 2023 addresses.

Section 14.03 of the revenue procedure says that attachments to opinion letter applications that were required for defined contribution plans and ESOPs in previous cycles are no longer required. This evoked “a sigh of relief” from some practitioners, according to Atlas.

Section 14.15 of Rev. Proc. 2023-37 clarified the rules for submitting opinion letters to indicate amendments made by a provider to its pre-approved plan in between cycles are not eligible for submission to receive an updated opinion letter.

Section 17.01(1) and Section 17.01(2) of the revenue procedure clarifies the scope of IRS review of a plan for a particular cycle to discuss a pre-approved plan submitted for an opinion letter in a prior cycle.

CODAs

Section 112 of the SECURE Act and Section 125 of the SECURE 2.0 Act amended Internal Revenue Code (IRC) Section 401(k)(2)(D) and IRC Section 401(k)(15) to require a qualified cash or deferred arrangement (CODA) to permit long-term, part-time (LTPT) employees to participate.

“This is a biggie,” said Noe. “This is a pretty big change,” he reiterated, adding that there are “probably a lot of questions out there about how this will work.”

RAPs

Section 6.03(1) of Rev. Proc. 2023-37 clarifies that the remedial amendment period applicable to a disqualifying provision related to an interim amendment. And the RAP for a disqualifying provision arising from a discretionary amendment made by an employer expires at the end of the cycle.

User Fees

“It’s been quite a while” since there has been a major increase in fees, said Atlas.

The IRS is “trying to take a realistic view in setting fees,” Atlas said, and indicated that it can be complicated to do so, adding, “Our program can’t be measured purely in time charges and overhead.”

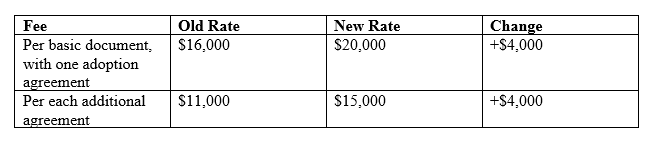

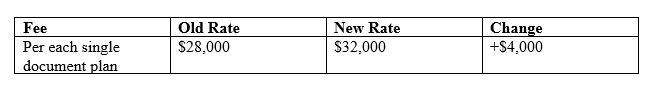

Following are changes in fees effective July 1, 2024.

Mass-Submitter and Non-Mass Submitter Plans with Adoption Agreements

Mass-Submitter and Non-Mass Submitter Single-Document Plans with no Adoption Agreements

In response to a question regarding whether user fees for Jan. 31, 2025 submissions will be fixed in 2024, Atlas and Noe said they “do not anticipate changing fees that are so close to the end of a submission window.” They continued, “The annual Rev Proc is normally issued in the first week of January, which creates logistical problems that would not be customer-oriented.”

Further, they said, certain increases have already been built into Rev. Proc. 2024-4, which take effect July 1, 2024. They added that they expect that the fees in place as of July 1, 2024 will be the same fees in place as of Jan. 31, 2025.

- Log in to post comments