By Steve Hanson and Richard Ford

This article originally appeared in the Summer 2013 issue of 403(b) Advisor Magazine. If you would like to view a PDF version of this article, please click

HERE.

Guaranteed income, while very important, does come at a cost to the client. An analysis shows that these products provide much more value to the client when used as part of a customized income strategy than when used on a stand-alone basis.

With 10,000 Americans turning 65 every day, there is no shortage of potential clients asking for your help in determining if, when and how they will be able to retire. Sixty-one percent of Baby Boomers say they’re more afraid of running out of money than they are of dying. While some who reach retirement age may be opting to continue working so they can rebuild savings impacted by the recession, many are looking to you to help them retire in the lifestyle they’ve worked so long for and desire.

Retirees are asking:

- Have I saved enough money to live the lifestyle I want?

- Will my money last as long as I live?

- How can I maintain control of my portfolio and make changes when I need to?

Advisors tell us they are concerned about:

- Increasing demand for their time, advice and personalized solutions.

- Not having the knowledge or customized solutions to meet client needs over an uncertain period of time.

- Growing their practice as retirees draw down on their savings, rather than contribute to them.

Making the transition from retirement accumulation planning to retirement income planning can be a challenge for even the most experienced advisor. While there is a nearly limitless list of strategies for providing income from a client’s investments, there is a smaller number of retirement income strategies commonly utilized by independent financial advisors. This article compares some of the more commonly used strategies, including:

- Variable Annuity with a Guaranteed Lifetime Income Rider (both a “standard surrender” variable annuity and a “short surrender” variable annuity)

- Fixed Indexed Annuity with a Guaranteed Lifetime Income Rider

- Time-Segmented Income Strategy

- Market-Responsive Withdrawal Program

- Customized Income Strategy that combines: (1) an immediate lifetime income annuity with a market-responsive withdrawal program; and (2) a variable annuity with a guaranteed lifetime income rider (both “standard surrender” variable annuity and a “short surrender” variable annuity) with a market responsive withdrawal program.

- Longevity Insurance Strategy that combines a market-responsive withdrawal program with a deferred lifetime income annuity.

Utilizing financial market and other economic data dating back to 1926, we tested each scenario using both back-testing and Monte-Carlo simulation methodologies. We then compared the relative advantages and disadvantages of these strategies from the perspective of both the client and the financial advisor and ranked the strategies based on key criteria to produce an overall report card on each strategy. Key considerations of a retirement income program from the client’s perspective are:

- Amount of income generated

- Amount of income guaranteed for the client’s lifetime

- The residual value of the account at the end of the desired timeframe (legacy)

- The liquidity of the assets throughout the income time horizon

The financial advisor’s primary goal, of course, is to ensure that the client needs relative to the factors mentioned above are met. That being said, no matter how effective an income strategy may be, it will not gain acceptance in the advisor community unless the advisor can implement it efficiently and be fairly compensated for the services that they provide the client. Therefore, the following additional factors must be considered by the financial advisor:

- Ease of implementation (both initially and ongoing)

- Income generated by the strategy for the financial advisor (both up-front and overall)

Following are descriptions of these strategies:

Variable Annuity with a Guaranteed Lifetime Income Benefit (GLIB)

There are many flavors of variable annuities with lifetime income riders, but most of them provide a guaranteed rate of growth to the “benefit base” prior to the client taking income and then guarantee income equal to a percentage of the benefit base even if the client’s account value should fall to zero. These contracts typically also have a “step-up” provision that allows the benefit base to increase if the contract value exceeds the benefit base. These contracts have been very popular in recent years and account for a very large portion of variable annuity sales.

The two forms of contracts included in this analysis are the “standard surrender” contract and the “short surrender” contract. The standard surrender contract generally has a longer surrender period (typically seven years) and lower contract expenses as compared to the short surrender contract. Also, the standard surrender contract will typically pay a higher upfront commission and either no asset-based trail or a lower asset-based trail than the short surrender contract.

Fixed Indexed Annuity with a Guaranteed Lifetime Income Benefit (GLIB)

This is very similar to the variable annuity strategy, but the funding vehicle is a fixed indexed annuity rather than a variable annuity. We did not perform simulations for this strategy — mainly due to the difficulty of modeling FIA caps, spreads and/or participation rates. These mechanisms are an integral part of determining the return on the contract, but they are not tied directly to any index or asset class that can be modeled. While, generally speaking, caps, spreads and participation rates are related to current interest rates and market volatility, they are ultimately set at the discretion of the insurer.

That being said, the results of the variable annuity products can be used as a proxy for the results of the FIA products. FIAs have a lower upside and a lower expected return than VAs, but they also don’t have as much of a downside. Thus, one would expect the income and residual account balance for the FIA to be lower than the variable annuity for the median and 75th percentile cases and equal to or better than the variable annuity for the 25th percentile cases.

Time-Segmented Withdrawal Strategy

This strategy was developed to address one of the key issues with a traditional systematic withdrawal program — sequence of returns risk. In this strategy, the client divides their assets into segments (typically with 5, 10, 15, 20, and 25-year time horizons). As the time horizon of each segment is increased, so is the risk profile of the segment. At the inception of the strategy, the client invests enough money into a five-year SPIA or a money market fund to provide them with five years of income. Every five years, a segment is liquidated and the proceeds are used to purchase another five-year SPIA or money market fund, thus providing an additional five years of income. The theory is that the more aggressively invested segments have longer time horizons and are, thus, more likely to produce returns equal to their long-term historical averages.

Market-Responsive Withdrawal Program

This strategy is an adaptation of a traditional inflation-adjusted withdrawal strategy. The client invests their assets in a moderate asset allocation portfolio and takes systematic withdrawals from the portfolio. Each year, the client’s withdrawals are automatically adjusted upward or downward based on the performance of the account in accordance with the predetermined rules. By implementing these rules, the initial withdrawal rate can be dramatically increased as compared to a traditional systematic withdrawal program without decreasing the probability of success.

Customized Income Strategy

The Customized Income Strategy combines a Market-Responsive Withdrawal Program with a source of guaranteed lifetime income (either a Lifetime Income Annuity or a Variable Annuity with a Guaranteed Lifetime Income Benefit). The primary tenet of this strategy is that every client should establish a “floor” of guaranteed income to meet their essential income requirements. To the extent that this floor is not covered by Social Security, pensions or other guaranteed sources, the guaranteed income product (either an immediate lifetime income annuity or a variable annuity with a guaranteed lifetime income benefit rider) is used to fill the gap. For the client’s non-essential income, a market-responsive withdrawal strategy is utilized.

Longevity Insurance Strategy

The Longevity Insurance Strategy is designed for the client who is reluctant to commit a significant portion of their retirement assets to a guaranteed income product due to liquidity or expense factors. In this strategy, the client initially generates all of their income from a Market-Responsive Withdrawal Program. However, the client also allocates a small portion of their assets to a deferred lifetime income annuity that will begin paying the client a stream at some point in the future (typically 20 years later). Because the client has a guaranteed income stream that they know will commence in 20 years, they can confidently withdraw more income from their Market-Responsive Withdrawal Program than they would otherwise. Also, the cost of the deferred income annuity is significantly less than the cost of an immediate income annuity.

Testing Results

Variable Annuity with a Guaranteed Lifetime Income Benefit (GLIB)

The stand-alone variable annuity with a guaranteed income rider ranked fairly low in terms of its ability to generate income for the client over the long term. This is due to the fact that compared to the non-guaranteed solutions that were tested; there is a relatively high cost to implement such a strategy due to the variable annuity contract and rider expenses. These expenses eroded the client’s purchasing power over time in our simulations. For similar reasons, this strategy ranked in the lower third for liquid account value and residual account value. The primary appeal of such a solution is the ease of implementation, due to the fact that it is a “single application” solution. Also, the potential up-front compensation to the advisor was the highest among the alternatives, though total income to the advisor over the client’s lifetime was actually the lowest.

Time-Segmented Withdrawal Strategy

The time-segmented withdrawal strategy ranked in the top third of the strategies tested in terms of total purchasing power provided to the client; however, this strategy provides little in the way of guaranteed lifetime income. Residual account value and liquid account value were low due to the fact that a large portion of the account value is initially invested in a period-certain income annuity to provide for the first five years’ worth of income. Every five years, another substantial portion of the account is liquidated and used to purchase another period-certain annuity, further eroding liquid account value and residual account value. From the advisor’s perspective, this strategy ranked the lowest in terms of ease of implementation and up-front compensation, though it was in the middle of the pack in terms of total advisor income over the life of the client.

Market-Responsive Withdrawal Strategy

The market-responsive withdrawal program ranked very high in terms of the purchasing power provided to the client, though it does not provide the client with any guaranteed lifetime income. Because it is a relatively inexpensive strategy to implement and the assets remain in accounts that are free from withdrawal penalties, this strategy ranked highest in terms of residual account value and liquid account value. While this strategy requires an annual review process, it still ranked relatively high in terms of ease of implementation. The primary downside from the advisor’s perspective is that it provided little up-front compensation, but it did rank highest in terms of overall income to the advisor over the life of the client.

Customized Income Strategy

The customized income strategies, whether the guaranteed portion of the client’s income was provided by an income annuity or a variable annuity with a lifetime income rider, performed similarly in our tests. They ranked in the lower half in terms of total purchasing power — again attributable to the additional costs associated with providing guaranteed income. For that additional cost, the customized income strategies did provide a high level of guaranteed lifetime income that was “customizable” to meet the specific client’s needs. These strategies also ranked high in terms of residual account value and liquid account value because only a portion of the client’s assets was tied up in products with surrender restrictions and higher costs. The customized strategy is somewhat more difficult to implement, as it does require the sale of multiple products, but it is less complex than the time-segmented withdrawal strategy. Finally, these strategies ranked in the upper half in terms of initial and total advisor income — indicating that the advisor is fairly compensated for the services being provided.

Longevity Insurance Strategy

The longevity insurance strategy provided the most total purchasing power and ranked in the middle of the pack in terms of guaranteed lifetime income. It also ranked in the middle in terms of residual and liquid account value, ease of implementation and initial and total advisor income.

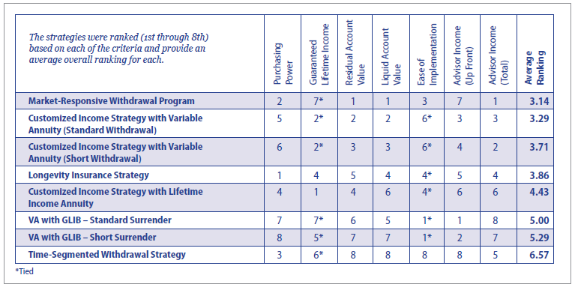

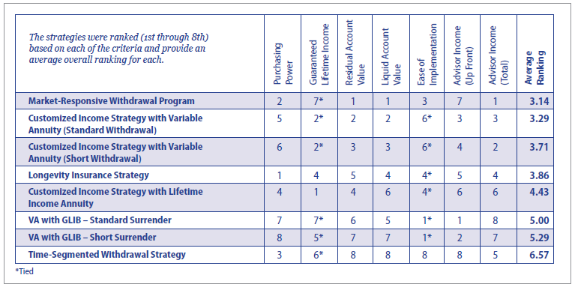

Strategy Report Card

The report card shown in the chart summarizes the results of our testing based on the following criteria:

- Purchasing Power — the amount of income that the strategy can reliably provide the client

- Guaranteed Lifetime Income — the amount of guaranteed lifetime income the strategy produces

- Residual Account Value — the residual value of the account at the end of the desired timeframe (legacy)

- Liquidity — how easy will it be for clients to access their money should the need arise during the income time horizon

- Ease of Implementation — a measure of the ease with which an income strategy can be implemented (both initially and ongoing)

- Advisor Income (Up Front) — compensation received up front for the work done to ensure that clients have income streams that meets their needs

- Advisor Income (Total) — cumulative compensation received for the work done to ensure that the client has an income stream that meets their needs given a time horizon.

Conclusions

While the rankings in the previous section can help advisors determine the relative overall effectiveness of the various strategies, there is no single strategy that is right for all clients. Also, just because a strategy has a high overall ranking that does not necessarily mean that it will be appropriate for any given client. For example, the stand-alone Market-Responsive Withdrawal Strategy — despite its high overall ranking — would not be appropriate on its own for a client with a need for guaranteed income. Conversely, a Customized Income Strategy that includes a guaranteed income component would not be appropriate for a client who has enough guaranteed income coming from Social Security or pensions.

One point that is clear is that guaranteed income, while very important, does come at a cost to the client. It will be very rare to find a situation that justifies putting all of the client’s assets into a guaranteed income product such as a variable annuity with a guaranteed lifetime income benefit — the cost of the benefit is just too high. As shown in our analysis, these products provide much more value to the client when used as part of a Customized Income Strategy than when used on a stand-alone basis.

When implementing a Customized Income Strategy, the choice of the guaranteed income component (lifetime income annuity versus variable annuity with guaranteed lifetime income benefit) has little effect on the outcome for the client. The Lifetime Income Annuity, in general, will provide slightly more guaranteed income but with less liquidity. The shorter surrender period variable annuity is likely to produce less total income for the client than the standard surrender variable annuity or the lifetime income annuity.

In the end, the choice of income strategy will come down to the advisor’s preferences and the client’s needs. Regardless of the strategy you select, look for products and planning resources to help you effectively implement the strategy.

***

Steve Hanson is Vice President Strategic and Product Development for PlanMember Services. He is responsible for project management, development of alternative distribution platforms, supporting internal and external investment groups and overseeing strategic planning and product development initiatives. Steve can be reached at 800-874-6910 x 2504 or [email protected].

Richard Ford is Senior Vice President Chief Marketing Officer for PlanMember Services. He is responsible for employer group development, marketing, web development and strategic alliances for PlanMember’s business lines. Richard can be reached at 800-874-6910 x2400 or

[email protected].

Recent Comments

Does the roth requirement for catch-up contributions for people who earned $145,000 apply to 457...

Hi Ed,

I really liked this article and I think you make a lot of sense. And I had no...

I believe there's a misstatement in that last quote - it should refer to governmental and...

Working with several medical providers as clients, I note that the high-end earners tend to push...

Congratulations to NTSAA for landing a good one. Nathan's breadth of experience and...