By Scott Hayes

This article originally appeared in the Summer 2011 issue of 403(b) Advisor Magazine. To see a PDF version, please click HERE.

Ensuring that clients understand the nature of the client-advisor relationship and demonstrating the value the advisor adds, will help advisors make the transition through the ever-changing regulations.

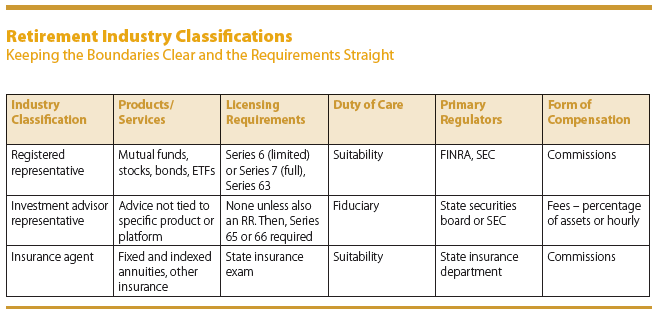

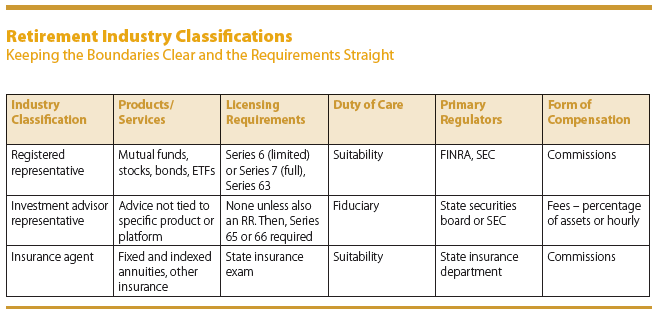

When financial services professionals (herein after referred to as advisors) provide products and services to 403(b) and 457 retirement plans and their participants, they do so under one or more of the following industry classifications:

- Registered representative (RR)

- Investment advisor representative (IAR)

- Insurance agent (agent)

Each of these classifications carries different requirements in licensing, regulatory oversight, product and service availability, continuing education, compliance programs, and duties of care. The advisor who falls squarely under only one of these classifications has a well-defined regulatory framework:

- Insurance agents are regulated by the states’ departments of insurance

- IARs are regulated either by the state or the Securities Exchange Commission (SEC) depending on assets under management. (The threshold for SEC registration is $100 million under management.)

- RRs are regulated by state securities boards, the Financial Industry Regulatory Authority (FINRA) and the SEC.

In the 403(b) and 457 realms, insurance agents typically use fixed and indexed annuities for their clients. Registered representatives can offer mutual funds or custodial trust accounts that purchase mutual funds or exchange-traded funds (ETFs) depending on the type of registrations the advisor holds. Investment advisor representatives sell advice for a fee and typically don’t receive any remuneration from the investments they recommend.

More often than not, advisors have the ability to provide products and services that cross the clear boundaries of a singular classification and many have the ability to act in all of those capacities at different times with different clients. A registered representative, for example, can recommend fixed annuities if he’s also licensed as an insurance agent, and an investment advisor representative might recommend a variable annuity to a client if she’s also both a registered representative and a licensed insurance agent.

When the client-professional relationship contains elements of more than one of these classifications, the lines of demarcation can get blurry and clients often have a hard time understanding the differences. This is further complicated when an advisor also engages in outside business activities such as estate planning or selling long-term care and life or health insurance.

Regulatory Pitfalls

An example may help define the problem. Jack is a registered representative and an investment advisor representative. He also has an insurance license. Beverly is a long-time client of Jack’s and for the past 10 years she has retained Jack to manage her investments on a fully-disclosed investment advisory basis. He’s also the broker of record on most of her accounts.

Beverly has recently retired and she’s concerned about the possibility of running out of money so she’s turning to Jack for advice. After analyzing the different options available, Jack recommends that Beverly transfer a portion of her taxable savings that he doesn’t currently manage into a longevity annuity that will start paying Beverly an income once she attains the age of 85 if she lives that long. She acts on Jack’s recommendation and Jack earns a commission from the sale.

In what capacity is Jack operating with this recommendation? Is he acting as an IAR because of his existing relationship with Beverly? Or is he acting as an insurance agent due to the new product sale? Which regulatory agencies have authority over this transaction? Which standard of care applies in this situation – suitability (as required for registered representatives) or the more stringent fiduciary duty standard required for advisory representatives?

Like everything else in the world of compliance, the answers depend largely on the facts and circumstances of the situation. Jack has a fiduciary responsibility to Beverly in his capacity as an IAR, and he cannot likely obviate this duty by simply claiming that this recommendation is made external to the advisory arrangement. Therefore, the SEC or state securities board may have authority to scrutinize the recommendation as the regulator over investment advisors.

The department of insurance clearly has authority to oversee the suitability of the annuity purchase transaction. FINRA also has the ability to scrutinize the recommendation if the annuity is funded with the proceeds of the sale of a registered or private security, even though Jack doesn’t currently manage it.

So from a compliance perspective, how can advisors avoid the potential regulatory pitfalls that result from reporting to multiple regulatory agencies, each with its own differing set of rules?

For starters, advisors who are affiliated with broker-dealers and RIAs should work closely with their compliance personnel to ensure they have a solid understanding of the firm’s policies and procedures, and they should not hesitate to ask questions when they arise. Compliance officers usually have direct experience in working with the regulatory agencies and they should be happy to provide their advisors with guidance and perspective at any time

Advisors should take care to explain any changes in their role in managing customer accounts and document this explanation in the clients’ files. In the aforementioned example, Jack should take the time to explain to Beverly that he is acting in an agent capacity with the annuity recommendation and how that is different from (and outside of) the scope of his advisory relationship with her. In order to avoid any potential fiduciary breach, he should also disclose the commission that he receives on the sale of the product. These verbal disclosures should likewise be translated to written acknowledgments by the customer, Janet. Because Jack is managing her other accounts on a fully disclosed basis, this should not be a difficult conversation.

An advisor who provides clients the option of working for them on a commission basis or a fee basis should thoroughly explain the difference and let the client make an informed decision. Neither option is inherently right or wrong; what’s best for the client once again depends on the facts and circumstances of the situation. The customers’ risk and return objectives, the size of the accounts, the number and frequency of anticipated changes and other relevant details need to be considered when making this determination. Ultimately an advisor’s regulatory fiduciary responsibility always requires them to act in the best interests of their clients and this should be documented in connection with the advisor’s decisions with respect to a client’s account.

The regulatory landscape is continuing to evolve and as such, the lines of distinction between these different classifications are beginning to converge. Some of the changes in the works that will facilitate this convergence include:

- The SEC has proposed a uniform fiduciary standard that would also apply to registered representatives in addition to investment advisor representatives.

- FINRA wants to regulate RIAs. The SEC study required under Dodd-Frank contained three recommendations, one analyzing the possibility of creating a new self-regulatory organization (SRO) and a second which would grant that authority to FINRA.

- States (securities and insurance), SROs and other regulators like the SEC, Department of Labor, and others are now coordinating their examination and enforcement efforts.

- 12(b)-1 reform is next on the SEC’s agenda.

- Rule 408(b)(2) requiring full fee disclosure in ERISA qualified plans is effective next January.

All types of advisors will be well served to get out in front of these changes by evaluating their existing business models and planning to incorporate whatever changes ultimately come to pass, whether by regulatory action or by competitive market forces. Ensuring that clients understand the nature of the client-advisor relationship and getting comfortable with demonstrating the value the advisor brings to the table will help advisors make the transition through the ever-changing regulatory waters.

Scott Hayes, CFA, is executive vice president, chief investment officer and chief compliance officer at Institutional Securities Corporation (ISC) in Dallas. ISC is a full-service broker/dealer and registered investment advisor that specializes in offering retirement plan services to educators and non-profit employer groups across the country.

Recent Comments

Does the roth requirement for catch-up contributions for people who earned $145,000 apply to 457...

Hi Ed,

I really liked this article and I think you make a lot of sense. And I had no...

I believe there's a misstatement in that last quote - it should refer to governmental and...

Working with several medical providers as clients, I note that the high-end earners tend to push...

Congratulations to NTSAA for landing a good one. Nathan's breadth of experience and...